Celebrate Black Wealth with Us!

Celebrate Black Wealth with Us!

2nd Annual Black Wealth Awards Weekend

November 2025

Celebrate Black Wealth with Us!

2nd Annual Black Wealth Awards

November 2025

Atlanta, GA

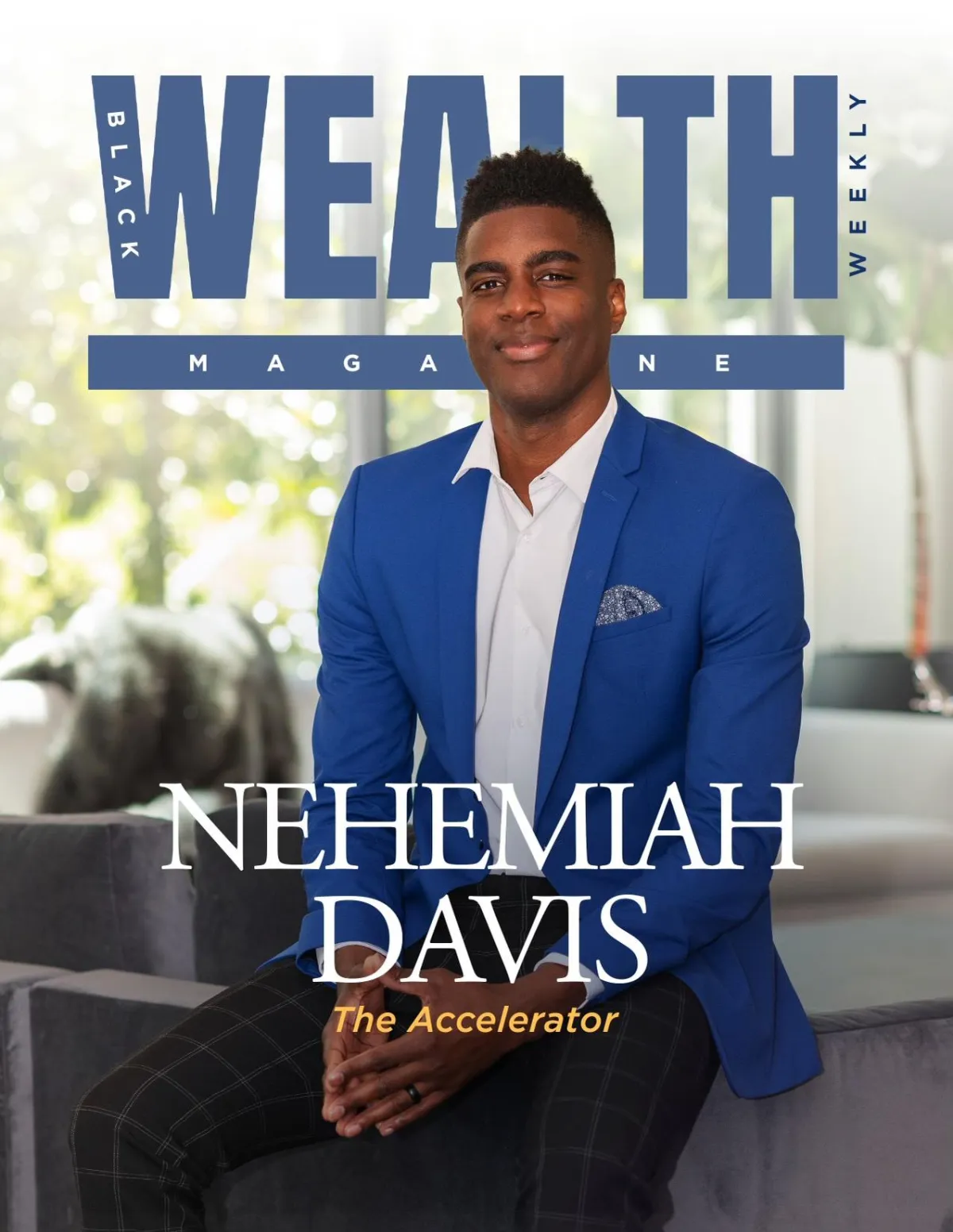

From $50 Consultations to Million-Dollar Success: Meet Sonia Lewis, The Student Loan Doctor

From $50 Consultations to Million-Dollar Success: Meet Sonia Lewis, The Student Loan Doctor

Aug 02, 2025

In a world where student loan debt has reached crisis levels, affecting over 40 million Americans, one woman has made it her mission to help people break free from the crushing burden of educational debt. Meet Sonia Lewis, better known as "The Student Loan Doctor" – a Philadelphia native turned Miami resident who has built a million-dollar empire by helping others eliminate their student loans.

The Accidental Beginning of a Movement

Sonia's journey into the student loan consulting world wasn't planned. It started with her own financial struggles and a moment of spontaneous leadership that would change her life forever.

"I was broke," Sonia admits candidly. "I went to a financial literacy course, and they weren't talking about student loans. Since my professional background was in higher education – helping people with the college process and explaining repayment – I wasn't new to the topic."

The pivotal moment came during that financial literacy workshop. When the instructor failed to address student loans, Sonia couldn't stay silent. "I found myself in the audience giving the answer because I was hyper-focused on this issue. So I stood up at this meeting and went rogue. I was like, 'I want to talk about student loans. This is not on the agenda. I am not a speaker.'"

That spontaneous teaching moment led to her first paid consultation request – and the birth of what would become a multi-million dollar business.

The Corner Bakery Chronicles: Humble Beginnings

What happened next is a testament to entrepreneurial hustle. Sonia started meeting clients at a Corner Bakery, charging just $50 per hour-long consultation – a rate she now admits was "way too little" but more than she was making per hour at her day job.

"I worked nine to five, then I would get off, drive straight to Corner Bakery, use the bathroom, order my little meal because I can't get kicked out now," she recalls with a laugh. "I had to find out who the manager was and flirt to get the booth. I still owe him a date – if you see this, sir, I apologize, it's not gonna happen, but I am grateful."

The manager even provided her with a "reserved" sign that probably wasn't supposed to exist at Corner Bakery. Her calendar filled up from 6 PM to 10 PM every day, and soon she was using her PTO for daytime appointments and booking weekend sessions at a second location.

Life-Changing Results: Six-Figure Debt Erasures

Seven years later, Sonia's business has helped close to 100,000 clients through courses, discovery calls, and consultations. The results speak for themselves – she's documented helping clients eliminate millions in student loan debt.

One particularly memorable success story involved a woman who owed $220,000. After following Sonia's advice to consolidate her FFEL loans to Direct loans – a seemingly simple but crucial step – the woman received loan forgiveness within 30 days.

"She came to an event in Atlanta just to tell me thank you," Sonia shares. "She bought a ticket to somebody else's event that I was speaking at just to thank me. She started twirling and crying – 'You got a quarter million dollars off my back!'"

But that's not even the highest amount. Sonia's team has helped someone get $600,000 in loans forgiven, and this year alone, they've tracked close to $6 million in forgiven debt attributed to their guidance.

The Power of Specialized Knowledge

What makes Sonia's approach so effective? She focuses primarily on specific forgiveness programs, particularly Public Service Loan Forgiveness (PSLF) and Total Permanent Disability (TPD) discharge.

"We are like the number one brand, and close to really the only brand that's hyper-focused on getting rid of student loan debt," she explains. "There are other consultants, but when you think of student loan debt, I can't think of any other brand that rivals us."

Her expertise shines through in understanding the nuances of federal loan programs. For instance, she helped a white gentleman with $90,000 in Parent PLUS loans who worked for a qualified organization but needed specific loan modifications to become eligible for forgiveness.

Serving the Most Affected: A Focus on Black Women

While Sonia helps clients of all backgrounds, her core audience consists of people aged 35-50, with a significant focus on Black women – a demographic that statistically carries the highest burden of student loan debt.

"I think when I started off, I was very hyper-focused on Black women as a Black woman, because statistically Black women have the most degrees and student loan debt, period," she notes. "Then the brand started to evolve to others outside of being a Black woman, but when we go back to numbers and loan forgiveness and who works in those public service fields – Black women."

The Million-Dollar Business Model

Sonia's success comes from making her services accessible. People are getting six-figure loan debt forgiven for less than $100 by working with her team. Her digital products are intentionally priced low because, as she puts it, "I don't have to charge a lot" due to the volume of people she serves.

She operates two main businesses: The Student Loan Doctor (her consulting service) and a digital product business, both of which have crossed the million-dollar mark. "Some months are great for both businesses, and I'm like, 'Ah, it's vacation time.' Other seasons, one carries the other."

Personal Growth and Future Vision

Beyond business success, Sonia's journey reflects personal growth and changing priorities. At 35, she's considering marriage and family while maintaining her business empire. She's also contemplating a move from Miami back to Atlanta to be closer to business relationships and opportunities.

"I realized that as a million-dollar earner, you need to be around others like that because the conversations are different," she reflects. "One thing we might say at lunch could change the narrative for our business."

Advice for College-Bound Students

Given her expertise, Sonia offers practical advice for those facing college decisions: "Your state college is your best option. State colleges have so much available to you, and then you need to go find your girlfriend and party at other schools on weekends."

She advocates for this approach based on her own experience attending a predominantly white institution in a quiet setting, which allowed her to focus on academics while still enjoying social experiences at other campuses on weekends.

The Legacy of Excellence

Sonia's drive for success is deeply rooted in family history. Her grandmother, one of seven children, was chosen by family vote to be the only one to attend college in the 1950s. That grandmother moved from the South to Philadelphia, started the family's Northern roots, and established a tradition of educational excellence.

"My grandmother had a stance that if you did not go to college, you went to the military, and there was a period behind it," Sonia explains. This legacy of high expectations shaped her approach to both business and family.

Looking Forward: Expanding Impact

As Sonia continues to grow her business, she's launching a podcast focused on "common sense for women" and planning more live events. She remains committed to her core mission while adapting to the constantly changing landscape of student loan policies under the Biden administration.

"Whenever Biden makes an announcement, I'm probably gonna make some money," she jokes. "I'll pull over and do a live: 'Guys, did you just see what came down the pipeline?'"

The Bottom Line

Sonia Lewis's transformation from a broke graduate student doing $50 consultations at Corner Bakery to a million-dollar business owner helping eliminate millions in student debt is more than a success story – it's a blueprint for turning expertise into impact.

Her journey proves that with the right knowledge, genuine desire to help others, and relentless hustle, it's possible to build something meaningful while solving a real problem affecting millions of Americans.

For those struggling with student loan debt, Sonia's message is clear: help is available, forgiveness programs exist, and sometimes that one sentence of advice you've been missing could be worth hundreds of thousands of dollars in debt relief.

To connect with Sonia Lewis and access her free classes and resources, follow @thestudentloandoctor on Instagram or visit her website for the latest updates on loan forgiveness programs and strategies.

Our Mission

Let's face it.. media buyers are a dime-a dozen these days and just clicking buttons is not enough. This isn't 2016 where you could just throw up a campaign and the platform would spit out conversions.

With attention spans getting shorter and creatives continuing to evolve, just pressing buttons is the quickest way to wasted ad spend. That's why we have trained our buyers to think outside of the box and really study the data around what drives the end user to click. Hint..Hint... Great offers & even great creatives.

Get a media buyer from MBU to handle your paid ads for any of the platforms below:

Facebook Ads

Google Ads

TikTok Ads

YouTube Ads

All Funnel Types

Precise Targeting

Why Hire A Media Buyer From MBU For Your Advertising Journey?

Let's face it.. media buyers are a dime-a dozen these days and just clicking buttons is not enough. This isn't 2016 where you could just throw up a campaign and the platform would spit out conversions.

With attention spans getting shorter and creatives continuing to evolve, just pressing buttons is the quickest way to wasted ad spend.

That's why we have trained our buyers to think outside of the box and really study the data around what drives the end user to click. Hint..Hint... Great offers & even better creatives.

Get a media buyer from MBU to handle your paid ads for any of the platforms below:

Facebook Ads

Google Ads

TikTok Ads

YouTube Ads

All Funnel Types

Precise Targeting

decrease operational costs & Increase Profits With Media Buying Unlocked!

Start Saving On Your Advertising Cost!

Doing under $50,000 per month? Then our media buyers are perfect for you! Get your offer validated and begin scaling with our verified media buyers at a fraction of the cost of an ad agency.

Eliminate Waste And Lost Revenues.

Diversify Your Advertising Dollars!

Satisfaction Guaranteed

decrease operational costs & Increase Profits With Media Buying Unlocked!

Start Saving On Your Advertising Cost!

Doing under $50,000 per month? Then our media buyers are perfect for you! Get your offer validated and begin scaling with our verified media buyers at a fraction of the cost of an ad agency.

Eliminate Waste And Lost Revenues.

Diversify Your Advertising Dollars!

Satisfaction Guaranteed

Getting Started Is As Easy As 1 - 2 - 3!

Tell Us About Your Project

Meet Your Project Manager

Launch Your Project

Getting Started Is As Easy As 1 - 2 - 3!

Tell Us About Your Project

Meet Your Project Manager

Launch Your Project

Keep Up With Us!

Every Week we interview high achieveing Professionals, CEO's, and Investors that are building Wealth their own way! Tap in to join the conversation and find your path to the Wealth you deserve.

The MBU Vetting Process

Recruit Passionate Performers

In-Depth Skill Assessment

Multiple Video Interviews

Sample Projects

Proper Management

Facebook and Instagram Ads

We utilize first party data and 3rd party attribution tools to be able to make better decisions on what's actually moving the needle for your brand.

Facebook and Instagram Ads

We utilize first party data and 3rd party attribution tools to be able to make better decisions on what's actually moving the needle for your brand.

Tiktok Ads

MBU media buyers are trained to use creative vanity metrics like video hook rate & video hold rate percentages to gauge what creative angles to test.

With more targeting options than Facebook & Instagram, our media buyers have the ability to diversify and allocate your budget to a platform that has unlimited potential.

Tiktok Ads

MBU media buyers are trained to use creative vanity metrics like video hook rate & video hold rate percentages to gauge what creative angles to test.

With more targeting options than Facebook & Instagram, our media buyers have the ability to diversify and allocate your budget to a platform that has unlimited potential.

Google Ads

With Google being so versatile, whether it's Google Search, Display, Shopping or YouTube, our media buyers have got you covered.

Let our team of highly driven media buyers take your brand to the next level.

Google Ads

With Google being so versatile, whether it's Google Search, Display, Shopping or YouTube, our media buyers have got you covered.

Let our team of highly driven media buyers take your brand to the next level.

But We Can't Forget About The Most Important Piece..

CREATIVES

As Creatives continue to be the driving factor for bringing in conversions outside of the actual offer itself, we are taking a different approach than most media buying placement firms.

All media buyers come with a deep knowledge of what makes a good piece of creative work and the metrics associated to make data driven decisions based on video hook rate & video hold percentages, outbound Click-through rates, & conversions.

Below are the workflow processes all of our media buyers go through to build a solid roadmap for testing & finding winning creatives in your ad accounts.

Creative Foundation

Creative Research

Creative Strategy

Creative Metrics

Creative Scaling

But We Can't Forget About The Most Important Piece..

CREATIVES

As Creatives continue to be the driving factor for bringing in conversions outside of the actual offer itself, we are taking a different approach than most media buying placement firms.

All media buyers come with a deep knowledge of what makes a good piece of creative work and the metrics associated to make data driven decisions based on video hook rate & video hold percentages, outbound Click-through rates, & conversions.

Below are the workflow processes all of our media buyers go through to build a solid roadmap for testing & finding winning creatives in your ad accounts.

Creative Foundation

Creative Research

Creative Strategy

Creative Metrics

Creative Scaling

Why Media Buying Unlocked?

-

Proven and Vetted

-

Fast, Expert Matching

-

Transparent Pricing

-

Personal Support

See How We Stand Out From Others

0-3 weeks

Platform

Platform

Platform

Platform

Platform

Why Media Buying Unlocked?

-

Proven and Vetted

-

Fast, Expert Matching

-

Transparent Pricing

-

Personal Support

Get The Same Scaling Foundations Used On Brands Like These!

Get The Same Scaling Foundations Used On Brands Like These!

See How We Stand Out From Other Media Buyers

Hire

Platform

Media Buyer Unlocked FAQ's

Media Buying Unlocked is 100% free for marketers. There are no startup costs, no yearly fees, and we take absolutely nothing from your set hourly rate. Media Buying Unlocked also takes on the payment responsibility for all of our marketers (i.e. we pay you, not your client). This means you get reliably paid every two weeks.

From driving client leads, to pre-qualifying them and everything in between, we have dedicated in-house teams supporting various aspects of building your freelance marketing career (whether you choose to do that full-time or by just putting in a couple extra hours every week). Every marketer is presented to clients one to one , meaning you'll never compete with another marketer for a project. When we match you with a client, we're confident you're the best fit for the project.

We accept only the top 5% of marketers who apply, and great marketers attract the best clients. From Buzzfeed, to Netflix, Allbirds, AngelList, and thousands more, we'll help build your portfolio of freelance work with some of the fastest-growing companies in the U.S.

The initial application process is very quick. First, fill out this form which takes as little as a few minutes. Then, we'll review your LinkedIn, so make sure it's up to date! The screening and onboarding process can then take as little as one week.

Media Buying Unlocked offers three types of engagements:

- Hourly: The client determines your hours per week based on your conversations and engagement scope. This type of engagement generally involves less than 20 hours per week, but can vary.

- Part-time: The client hires you on a fixed, 20-hour-per-week retainer.

- Full-time: The client hires you on a fixed, 40-hour-per-week retainer.

Media Buying Unlocked takes care of all invoicing and collections, and pays you every two weeks via ACH direct deposit. Typically, the funds will be available in your account on Fridays, but we encourage you to speak to your financial institution about ACH direct deposit, as each institution handles payment differently.

You can find out more about our payments schedule in your Billing Portal dashboard.

In general, we look for:

- 5+ years of channel-specific marketing expertise.

- Proven experience optimizing and scaling a channel, with data and case studies to back it up.

- People and communication skills, to build trust and rapport with clients.

- BONUS: Live in the U.S. or Canada. While we do accept applications from anywhere, we're currently focused on North America.

Media Buying Unlocked clients are anywhere from pre-seed to public companies, mostly in e-commerce (DTC), technology (SaaS and consumer), and media.

Every project and opportunity is different. You may be brought on as the client's first marketing hire, or as a supplemental resource working with a fully established marketing team.

Keep in mind: We'll work together to create a schedule that's best for you. Clients know that Media Buying Unlocked marketers may have a full-time job or other clients.

Media Buying Unlocked handles all legal forms (contracts, NDAs, etc.) and gets them signed by all parties.

You'll only sign one contract with MarketerHire when you're onboarded. We'll take care of all the direct contracts with clients including any redlines and negotiations.

We'll alert you about new opportunities with an email that includes a job description, company and engagement details and budget. If you reply back that you're interested in the engagement, our team will send your profile over to the client.

You can turn down as many engagements as you'd like for any reason. There is no penalty. We just ask that you get back to us ASAP — since Media Buying Unlocked's goal is to match clients with a marketer as quickly as possible, if we don't hear back in 24 hours, we'll offer the project to another freelancer.

We aim to match you to your first opportunity within 30 days after being accepted and completing your onboarding.

You set your own hourly rate and earn that rate 100% of the time. During your onboarding call, we provide rate guidance based on current demand, industry best practices, our own insights, and your experience.